At Red Hawk Realty, our real estate clientele vary from first-time home buyers to seasoned real estate investors, looking at new ways to make money in real estate. Regardless of their capital, personal needs, or financial background, they all have one thing in common; they do not want to get hosed on their next real estate transaction. No matter what, your goal when purchasing a new property is to make money, not lose it.

Follow the Real Estate Cycle

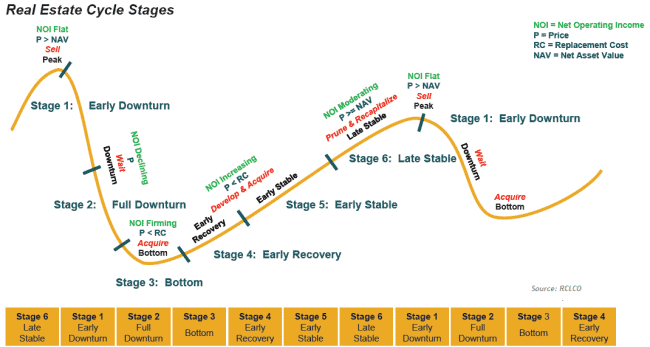

The most two common ways to make money through real estate investing is to go for positive cash flow properties or by buying low and selling high. When both strategies are combined, they harness the power of compounding. How does compounding work in real estate? The strategy of compounding works when buying the income property at the bottom of the real estate cycle, below replacement cost, generating income through rent, and selling at peak value, or well above replacement cost. Here’s what the stages of the real estate market looks like through out the real estate cycle compliments of CREOnline:

Smart investors will then take the capital from this investment and use what is known as the 1031 exchange (IRS Revenue Code 1031). This allows investors to defer capital gains taxes by rolling their funds into a replacement property within 180 days. The process then starts over – preferably in alignment with the acquisition phase (stage 1) of the real estate cycle.

Look for Buyer’s and Seller’s Markets

Timing is key when it comes to the real estate cycle. If you can recognize and predict downturns and recoveries, you can position yourself to sell and buy real estate when most profitable. BUY in a buyer’s market and SELL in a seller’s market – simple, right? Not quite.

For savvy real estate investors, the idea of a generalized U.S. housing market is a myth. Instead, the U.S. is comprised of thousands of micro-markets, each with their own real estate cycle. Understanding housing markets on a local level requires boots on the ground and real estate professionals or consultants who are experts in their locale.

The three most important metrics to consider in a buyer’s market are job growth, population growth and affordability. The movement of wealth dictates boom and bust cycles with respect to real estate markets. Ask your agent about these main indicators and other ancillary real estate trends if your target market is in a niche like ranching, agriculture or tourism.

Buyer’s and Seller’s Markets in Practice

Let’s look at a couple historic examples of the best buyer’s and seller’s markets. From 2000-2006, property owners experienced multiple offers and even bidding wars. The masses were buying, and supply was low. Then, from 2008-2012, the U.S. experienced one of the greatest housing crises in history. Fire sales, foreclosures, abandoned projects and upside-down mortgages became the norm.

Markets can change on a dime and a smart investor will position themselves with that in mind. Today is no different. We have markets experiencing housing bubbles in cities like Denver, San Francisco, Los Angeles, San Diego, Seattle, and Portland. These areas are a seller’s market. Despite recent events, experts predict that this will continue through 2020 and in to 2021. This should not be taken as a blanket statement, however. According to Kathy Fettke, Co-Founder of Realwealth, “2020 will be a great year to sell overpriced, underperforming assets and exchange them for underpriced, high cash flow properties in growing markets.” Beware of bubble markets where the income generated from the property does not cover the monthly nut. These underperforming properties can leave you high and dry during the downturn phase.

Buy and Hold vs. Fix and Flip

How does one navigate through the real estate market cycle to position oneself in favorable markets? Timing. Understanding when to buy and hold a real estate investment and when to sell is crucial. The transition from a downturn to a recovery can be fast or extremely slow. In stable markets, where appreciation is slow and steady, it may make more sense to hold and rent a property to build additional capital for a future investment. While waiting for the market to reach peak value, you can diversify your investment portfolio and reduce your risk.

In turbulent or bubble markets, over-extended property owners could have negative cash flow from rentals – with the sole expectation of appreciation to provide returns. This is where the fix and flip may be beneficial. If you can buy low and perform the biggest possible fixes at the lowest achievable cost, it’s possible to come out ahead. Remember: the cost of fixing should always be significantly less than the delta between the purchase price and the sale price. Don’t forget to consider closing costs, commissions, depreciation recapture and capital gains taxes (remember 1031!).

Understanding timing with respect to the market, the types of real estate investments and the main indicators of a buyer’s or sellers’ market are at the core of successful real estate transactions. Local knowledge is where investors can put themselves at a major advantage over the competition. Talk to a Red Hawk Realty agent today for the nuances of backcountry properties for sale in California and how to avoid getting hosed!