San Diego County Real Estate Advice

Real Estate Advice for Buyers – From Donn Bree and Meriah Druliner

Real Estate Advice for Buyers – From Donn Bree and Meriah Druliner

Information Shapes Motivation for Buying Property

A buyer’s motivation to purchase real estate may range from the purely aesthetic (beauty) to solely economic (value). The value of peace and happiness the right parcel of land can bring into your life may be greater than money. However, the right parcel of land can buy a lot of peace and happiness.

Regardless of your motivation, quality and timely information, along with patience goes a long way in your pursuit of peace and happiness. At Red Hawk Realty, we will provide all of the San Diego real estate advice you need to make the move that’s right for you.

Establish Professional Relationships.

There are at least three areas involved in a real estate buyers transaction each requiring professional guidance:

- The transactional tasks and sequence,

- The financing

- Assessing the property with respect to the buyer’s intended use.

A real estate broker, a mortgage broker, and licensed contractors are the professionals involved in this process. Consider selecting a broker who, rather than offers advice, empowers you with quality information. Your qualified real estate broker will be able to refer mortgage service and property evaluation options, if you are unable to independently contract these services.

Pre-Qualify Your Purchasing Power

It is wise to establish the limits of your purchasing power prior to looking at property. This can be done in a matter of minutes with an experienced mortgage broker. Borrowers are qualified based on the following criteria: credit scores; loan-to-value ratio; income from tax returns; liquid reserves; occupancy (owner or tenant); purpose of loan (purchase, lower rate, debt consolidation, cash out); and any extenuating circumstances (bankruptcy, etc.). The result is that you should know the price range, monthly debt service, and the cash you will need to successfully complete the transaction.

Draft A Plan

Identify all of the tasks and the timing involved in the process of your purchase. A simple place to start is by asking, “What is the outcome I see for myself?” A clear understanding of what you would like to accomplish with the purchase of real estate will make the process of identifying the tasks, the costs, and the sequence in which the tasks should be completed much clearer. Your broker can also provide a list of reputable, local service providers who can assist you with projects beyond the scope of acquiring of your property.

Understand Your Purchase In Terms As An Investment

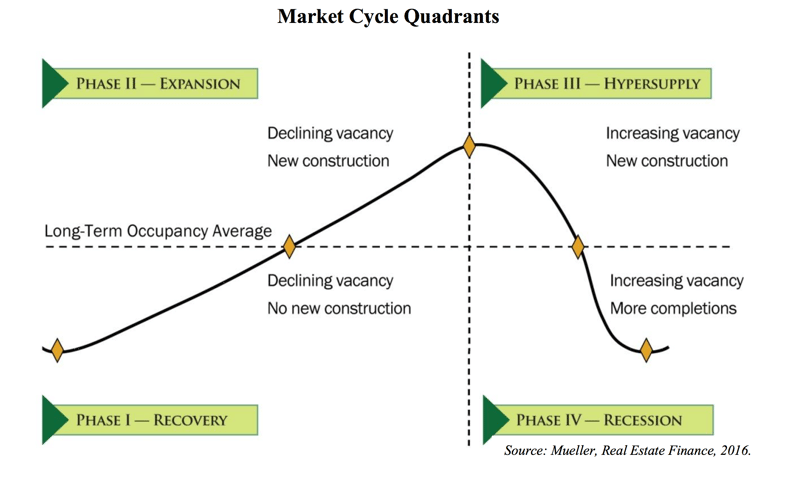

Strangely enough, many real estate purchases are made without the forethought of what the outcome will look like in the event that something in a person’s life changes, making it necessary to sell their property. The truth is that the duration for most ownership terms is seven years or less. The average real estate cycle, from peak to valley and back to peak, has historically taken about 10 years. A wise real estate investor understands that the only thing more important than location is timing.

Where are We on the Real Estate Cycle?

Of the real estate advice appearing on this page, the most important in terms of creating wealth through real estate is: be mindful of where you are on the real estate cycle. A competent real estate broker can provide you with the current trend in property value for your area. Factors influencing the value trend of real estate include: change in median home price; foreclosure volume; change in the number of housing permits; inventory of unsold homes and marketing time; mortgage rates; unemployment; and the percentage of people who can afford the median priced home.

An experienced real estate professional can provide and interpret information that will enable you to estimate the equity potential for your property over the period of time you plan to own it. Although there are no guarantees that history will repeat itself, it is the best tool available to predict future conditions.

Real Estate Tips for Borrowing

In my opinion, there seems to be a lack of trust between lenders and borrowers – and for good reason. This obstacle is easily overcome when the borrower understands the loan process and the costs involved in borrowing money.

A competent mortgage broker will educate clients, empowering them with information that will eliminate the mysterious anxiety that grows from not understanding how real estate financing works – or in other words, how much money was made off of the transaction by the broker and other service providers. It’s all in the pricing.

What goes on with your loan after you receive your money is a mystery to us all. Obtaining the best loan available for your particular set of circumstances is our focus.

The Important Variables

The variables in pricing a mortgage loan are the interest rate, the fees paid to service providers to facilitate funding the loan, and the compensation to the broker or bank arranging the loan (generally referred to as points, or an origination fee). Rebates, or yield spread premiums as they are sometimes referred to, are adjustments associated with pricing the interest rate, and of which an informed borrower should be aware.

As a rule, it is a bad idea to pay any sum of money to any service provider, with the possible exception of a licensed appraiser, prior to funding your loan.

Myth: no cost loans. There is no such thing. Can you think of anything in the world of finance that is actually free? How can a business sustain itself in a capitalistic society when not charging for services? A no cost loan is synonymous with a higher interest rate.

Follow this real estate advice to negotiate the best mortgage loan rate and terms for your specific situation.

1. Rate

Shop at least three lenders for the rate that applies to your given situation. Rates can change several times daily, but only in small increments which will not typically require a new rate quote on any given day. A qualified professional will be able to provide you with the lender parameters which apply to you.

2. Fees

Knowing the current interest rate, you can now identify the fees, and to whom the fees are paid. The rate you have been quoted should not change as a result of the disclosure of fees. Fee information is provided on a legal document referred to as a Good Faith Estimate. Understand this fact: if there are no fees, you could have received a lower interest rate.

3. Origination Fee or Points

Nobody works for free. Ask the broker how she/he is compensated. Typically, the broker or bank will charge a fee that is based on a percentage of the loan amount, referred to as points, or an origination fee. This fee is negotiable, but generally in the range of 1-2 percentage points of the loan amount funded. If there is no origination fee appearing on your Good Faith Estimate, then your originating broker or bank was probably compensated through a rebate or yield spread premium. Ask – and ask the amount of the rebate. In most cases, it is less expensive – and much less confusing – to pay the origination fees and eliminate rebates.

4. Rebates or Yield Spread Premiums

The longest running and best kept secret in the mortgage industry is the rebate, or yield spread premium paid to the broker and/or bank for selling you a higher interest rate than what you bargained for. If your mortgage loan originator (broker or bank) tells you they are being paid through an origination fee or loan points, tell them that you want to be reimbursed any rebate or yield serviced premium that results from locking the interest rate. This demand will quash the motivation of the originator to collect an additional fee at your expense without your knowledge.

Rebates and yield spread premiums do have their place in the mortgage market. A reputable mortgage originator can advise you of the appropriate situations for using these little known interest rate pricing adjustments.

I hope this was a helpful real estate advice, share your feedback with me below! Also check our our page on our advice for sellers as well as other informative topics in our blogs section!