What is Zestimate?

In 2006, Zillow, the online real estate website, launched a new estimate service called “Zestimate.” The beta provided valuations for 60 million on and off-market homes in the U.S. Zillow also provided historical data, real estate trends, comps, satellite images, as well as specs related to the property. The accuracy of Zestimate depends on how much information is publicly available and, according to Zillow, should be the starting point for determining a homes actual value. [1][2]

Initial Feedback on Zestimate was Mixed

In 2007, James R Hagerty of the Wall Street Journal studied the algorithm and stated that it is “often are very good, frequently within a few percentage points of the actual price paid. But when Zillow is bad, it can be terrible.” [3]

In October of 2006, the National Community Reinvestment Coalition filed a complaint with the Federal Trade Commission stating that stating that Zillow was “intentionally misleading consumers and real-estate professionals to rely upon the accuracy of its valuation services despite the full knowledge of the company officials that their valuation Automated Valuation Model (AVM) mechanism is highly inaccurate and misleading.” [4]

Since it’s release, Zestimate has been refined to a nearly 4 terabyte behemoth with 500,000 unique valuation models.

Using Zestimate to Flip Homes in Hot Markets

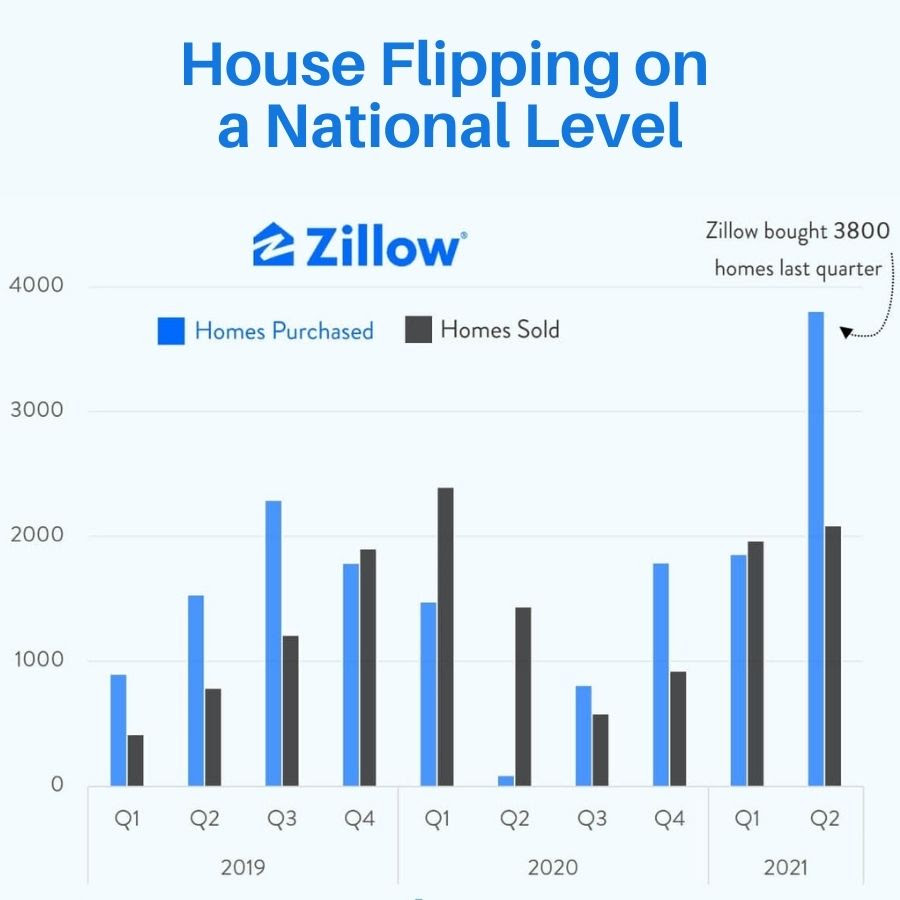

In 2018, Zillow launched it’s iBuying program and began using Zestimate to purchase and redevelop homes. They were so confident in their home pricing algorithm that they began using Zestimate as an instant cash offer for homes in hot markets, called Zillow Offers. Over the course of two years, Zillow Offers purchased 27,000 homes with the plan to flip them for a profit.

According to Zillow, they purchased over 3800 homes in the second quarter of 2021. On average they spent $322k on each home, $10k renovating it, $16k on selling it and sold each home for $370k — profiting just over $20k per home. To grow this branch, Zillow borrowed $450 million through mortgage bonds backed by the Zillow Offers inventory.

The End of iBuying for Zillow

Just eight months later, Zillow shut down the Zillow Offers iBuying program permanently explaining they were at operational capacity. The news comes after Zillow reported a $381 million loss in the last quarter. CEO Richard Barton also cited volatility and unpredictability in the housing market.

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility… Put simply, our observed error rate has been far more volatile than we ever expected possible, and makes us look far more like a leveraged housing trader than the market maker we set out to be,” Barton said in a press statement.

Another contributing factor is “a labor- and supply-constrained economy” according to Zillow COO Jeremy Wacksman. The market for home flipping has resulted in a major shortage of subcontractors in many of the booming markets Zillow operated in. The company saw its stock plunge and cut 2,000 jobs, or 25% of its staff. Zillow plans to sell the remaining 7000 homes they own and partially recoup their losses.

Zestimate’s AI Cannot Accurately Value Real Estate (Yet)

The real takeaway from the Zillow Offers debacle is that Zestimate was overpricing homes and Zillow Offers was paying for them. The fallout from Zillow Offers proves how difficult it is to use AI to make expensive, real-world real estate decisions in a dynamic market. Furthermore, predicting the market, turnaround and expenses associated with flipping homes in this market is difficult it is for anyone, period.

Since Zillow entered the space in 2018, the real estate market has fluctuated wildly. The pandemic led to a temporary housing market freeze, followed by a supply and demand imbalance that caused an unprecedented rise in home prices. Zillow also had to rely on roughly 2000 employees to evaluate the property in-person, assess the repairs needed, then make a final offer. Labor shortages and supply chain issues compounded these difficulties, pushing timelines and increasing costs.

Zillow’s Stock Slides

Zillow’s stock price fell 50% since October, when it first revealed it’s challenges with Zillow Offers. In November of 2021, Zillow has two class-action suits for allegedly misleading investors (who purchased the stock between January and November) and failing to inform them in a timely manner about the struggles of its iBuying business.[3]

Is Zestimate Accurate?

The Zestimate algorithm has been the trademarked bread and butter of Zillow, mentioned 61 times in it’s IPO paperwork in 2011. Zillow’s expectations to play with the other big tech stocks has been undermined by the shutter of iBuyer and Zillow Offers. Zestimate currently has a median error rate of 1.9% for homes listed on the market. For off-market homes, that number jumps to 6.9% according to Zillow spokesperson Viet Shelton. While those margins may seem small, the bottom line balloons when scaled to a multi-billion dollar house-flipping operation.

The Human Element of Real Estate

Zestimate is a good tool for what it is and should simply be used as a starting point for home valuations. For complex properties, like ranches, land, ag and commercial properties, count on a real estate expert to guide you.