Everything You Need to Know About…

Selling Alcohol on Private Property

Selling alcohol on private property in California requires the proper liquor license that applies to your business. The California Department of Alcohol and Beverage Control (ABC) has nearly 90 different types of liquor licenses available depending on where, how and what alcohol you plan to sell on your property. Performing due diligence before buying your property and applying for your required license can save an immense amount of time, money and frustration.

Fortunately, we’ve put together this helpful guide to explain:

- The types of liquor licenses available in California

- How to choose the right liquor license for your business

- Things to look out for when purchasing a property to make and sell alcohol in California

- The associated fees and expected application times

As the preeminent backcountry brokerage in San Diego, we’ve also put together some tips to help you find the perfect property to start or expand your dream winery, brewery, cidery, restaurant, tavern or bar for sale in San Diego County. There’s a lot to take in here – so if you have any questions, feel free to contact us directly.

Working With The California Department of Alcohol Beverage Control (ABC)

The ABC is a governmental agency in California that regulates the manufacture, distribution, importation and sale of alcohol state-wide. Unlike most property use regulations like zoning and permits, selling alcohol on private property in California requires a thorough application process via the department of the ABC.

State agents of the ABC review liquor license applications to evaluate the applicant of said license as well as the feasibility of selling alcohol on the proposed property or site.

It is important to note that approved liquor license applications are awarded to the business owner, not the location – this means that if you decided to move your business, your license is still valid. Additionally, when purchasing a business, licenses can be transferred through an alternative process with the ABC. If your application is denied, you may appeal the ABC’s decision through an appeal process.

Contacting the ABC:

You can find all permits, forms, FAQ and resources directly on the ABC website. You can also get questions answered by contacting the ABC directly:

The California Department of Alcoholic Beverage Control is headquartered in Sacramento, but has district offices throughout the state.

Phone: (916) 419-1319

Email: Sacramento@abc.ca.gov.

Address: 2400 Del Paso Road, Suite 155, Sacramento CA, 95834.

Office hours are from 8:00 a.m. to 5:00 p.m.

Zoning Restrictions

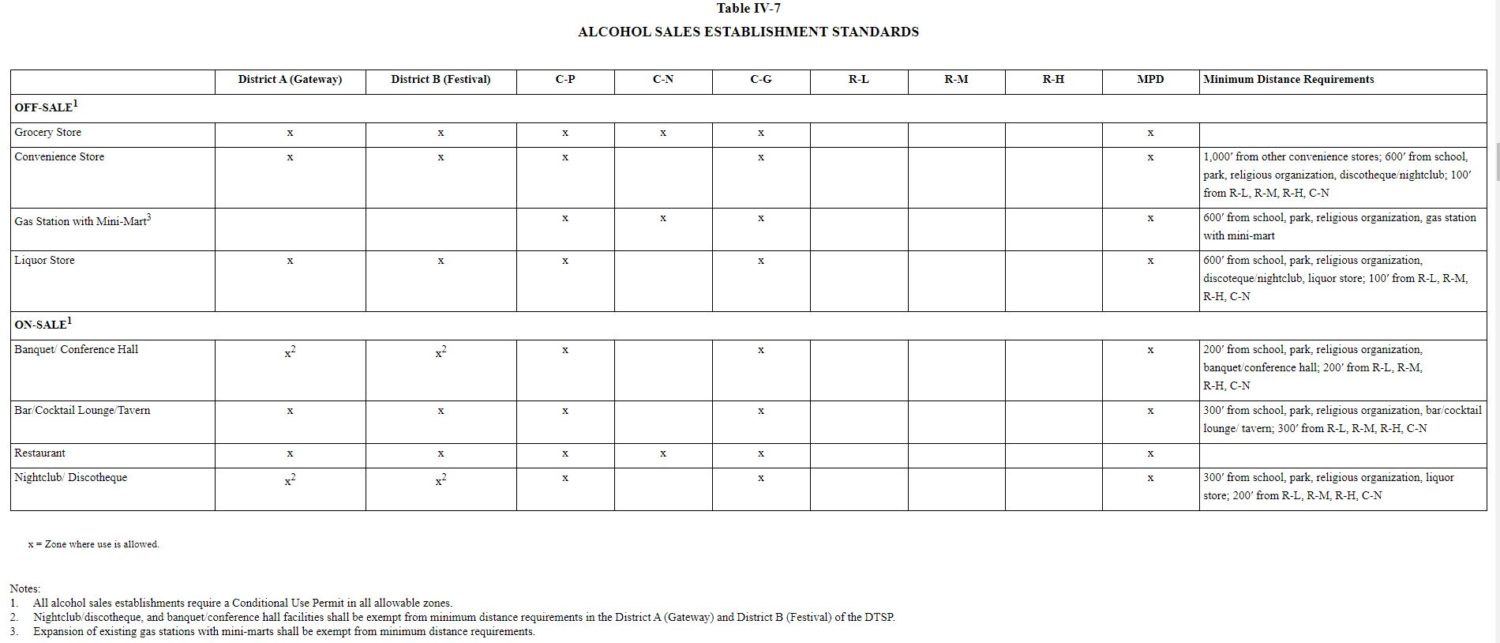

Making sure your property is zoned correctly for alcohol sales is critical to the approval of your liquor license. For retail, restrictions change based upon whether your business does “on-sales” or “off-sales.”

- “On-sale” establishments would be things like restaurants, bars, tasting/tap rooms and pubs, where patrons would be drinking alcohol on-site.

- “Off-sale” establishments would be retail stores where customers are not allowed to drink on-premises.

Proximity to things like churches, schools, parks and other alcohol sales establishments all have minimum distance requirements so consider this before making a real estate purchase or selecting a site for your business. Below is a useful table covering minimum distance requirements depending on the type of business. Keep in mind that changes to these distances may be approved by the ABC with proper permitting and appeals.

https://qcode.us/codes/huntingtonpark/view.php?topic=9-4-2-9_4_203&frames=on

https://qcode.us/codes/huntingtonpark/view.php?topic=9-4-2-9_4_203&frames=on

Applying for a Liquor License in California

Each liquor license has an application fee and surcharges (surcharges are typically $24 or $52 depending on license type with a $10 California Highway Patrol surcharge), an annual fee that must be paid for renewal, and a $63 fingerprint fee for background checks. (Surcharges based on 2021 research. Visit the ABC fees page for details)

Types of On-Sale Liquor Licenses

As mentioned above, there are nearly 90 different types of liquor licenses in the state of California. One important thing to consider is the popularity of each license and if they have a cap on the number of licenses to issue. For the purposes of maintaining wide-spread appeal and applicability, we will focus on the most common types of on-sale liquor licenses in California issued by the ABC. We will also only focus on licenses focused on smaller-scale production and sales.

Type 02 – Winegrower License

For winery sales and tastings on-premises, a winegrower must have facilities and equipment for the conversion of fruit into wine and engage in the production of wine.

Type 23 – Small Beer Manufacturer

The Type 23 license is for “Micro-Breweries” and “Brewpubs” producing less than 60,000 barrels of per year. These licenses grant the same privileges of a Type 01 license but at a smaller scale for a lower price.

Type 41 – Beer & Wine ONLY On-Sale in a Bona Fide Eating Place

This is one of the most common licenses issued by the ABC. It is important to note that in the case of liquor licenses, the term “bona fide eating place” applies to businesses where a majority of their sales are from food and they have a suitable kitchen to serve said food. The Type 41 license is predominantly for businesses that sell food and only occasionally beer and wine.

Type 47 – On-Sale General Bona Fide Eating Establishment

This is a license issued to restaurants selling food as well as beer, wine and liquor. When you hear of a restaurant with a “full-bar” – they have a type 47 liquor license.

Type 48 – On-Sale General Public Premises

A bar, pub or tavern where the majority of their sales come from alcohol. All patrons must be 21 or over.

Type 75 – On-Sale General Brewpub

A Type 75 Brewpub license authorizes the sale of beer, wine, and distilled spirits for consumption at a bona fide eating place. It’s important to note that there is no cap on Type 75 Licenses.

Duplicate Licenses

A on-sale licensee who maintains a business with one or more rooms that serve alcohol must apply for a duplicate license to sell alcohol in that secondary room.

License Transfers

A license transfer application must be submitted to the ABC and can take up to 65 days to reissue. The transferee may operate the licensed premise during the transfer period if a 120-day permit has been obtained. To qualify for this temporary permit, the premises must be currently licensed and have been operating within the past 30 days prior to application.

Alcohol Sales Taxes, Compliance, Shipping & Insurance

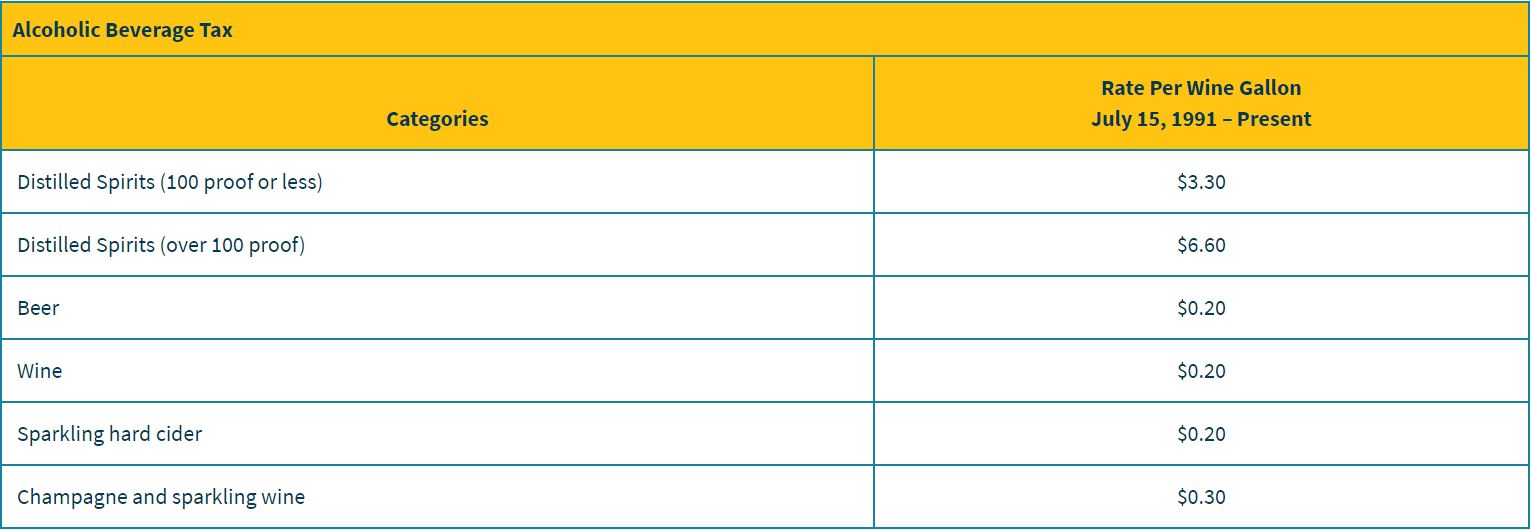

Alcohol Sales Taxes

In California, tax rates are dependent on the type of alcohol produced and sold. For a complete list, visit the CDTFA for tax rates. Additionally, shipping companies like FedEx and UPS require an adult signature to complete the delivery.

Source: CDTFA

Source: CDTFA

Shipping Laws for Alcohol Sales

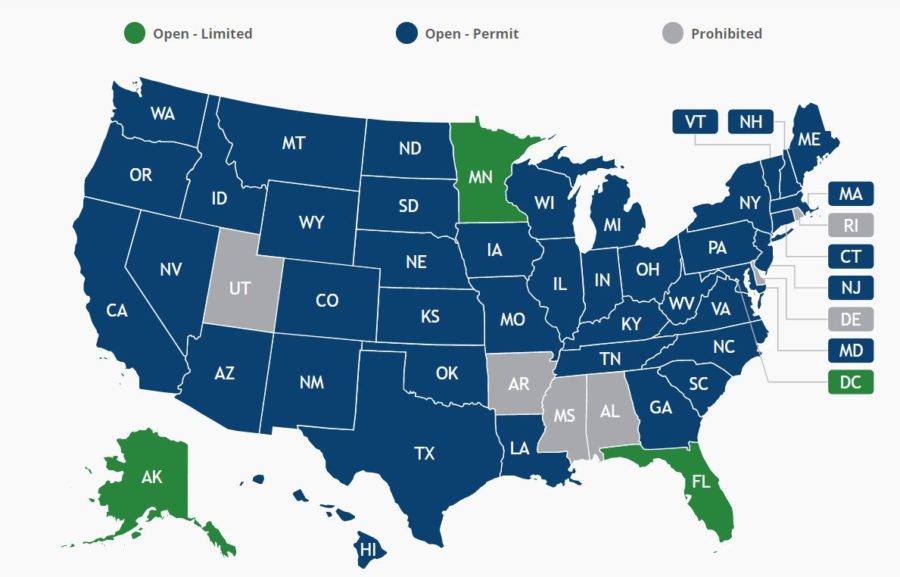

Under the 21st amendment, each state can design its own laws for importing and selling alcohol. Navigating state-by-state shipping compliance is often handled by third-party services or distributors simply due to the leg-work required to ship nationally.

Wine Shipping

For direct-to-consumer (DTC) wine sales, each state has their own licensing and compliance requirements for shipping. Click the link for an interactive map from wineinstitute with each state’s individual requirements. Each state requires a form like this one (from the ABC) for DTC sales.

Source: WineInstitute.com

Beer Shipping

Direct-to-consumer shipping of beer is a much more difficult prospect compared to wine simply because not many states allow DTC beer sales. Currently, only a handful of states—Nebraska, New Hampshire, North Dakota, Ohio, Oregon, Vermont, and Virginia, plus the District of Columbia—clearly permit the DTC shipping of beer from licensed brewers located anywhere in the country. Here’s a helpful article explaining DTC beer sales.

Spirits Shipping

For distillers, DTC is an even greater challenge. While more than 40 states let retailers sell alcohol online, only 10 states that allow the same privilege to producers are significantly lower. Just like with DTC beer and wine sales, many distillers must use third party services to overcome shipping hurdles. More here.

Alcohol Sales Laws and Liability

For retailers (License Types 20, 21, 40, 42, 48, 61), the ABC requires the following:

- Signs – “no loitering” and “no open containers” if requested by law enforcement

- No drinking inside an off-sale (store) or outside an on-sale (bar) premises

- Good lighting outside

- Remove litter daily; sweep weekly

- Graffiti removal – 3 days

- Keep 2/3 of windows and doors clear

- Pay phones – no incoming calls if requested by law enforcement

- “Adults only” area for videos

- Keep Standards on premises

Pertinent Alcohol Laws

Section 25658(a) Business and Professions Code (Sale to a Minor): Selling Alcohol To a Minor will result in a misdemeanor

Section 25658(b) Business and Professions Code (Purchase/Consumption by Minors): Purchase and on-site consumption of alcohol by a minor will result in a misdemeanor

Section 25665 Business and Professions Code (No Person Under 21 Allowed): Allowing a minor to enter and remain without lawful business will result in a misdemeanor

Section 13202.5(a) Vehicle Code (Use-Lose Law): Drug or alcohol related crimes while operating a motor vehicle shall result in the suspension or delay of a drivers license application for one year.

For a full list of laws and liabilities, click here. Keep in mind that your business may be held liable for over-serving an individual, serving underage individuals or allowing public drinking. Failure to adhere to the laws may result in penalties and the suspension or revocation of one’s liquor license.

Getting Help Finding the Perfect Property for Your Business

We assist our clients with a wide variety of properties all across California. From San Diego restaurants to hobby wineries, the agents at Red Hawk Realty can find your next site to sell alcohol. Speak with one of our agents today.