Understanding Land Trust, Rental Investment Properties, Commercial Properties, Vacation Homes and Other Property Trusts

There are many different types of trust options when it comes to real estate property. From residential, land/lots, vacation homes, commercial property, rental investment property, etc., each has their own use and purpose. Let’s look at property trusts and see if they are right for your next real estate purchase.

What is a Land Trust?

A real estate trust, also known as a land trust is a contractual organization or arrangement that takes partial control through ownership of property on behalf of the property owner. The owner gives up control of the property in order to shield themselves from certain legal proceedings and tax exposure. Though the title transfer has taken place, the original property owner does not give up their claim to ownership of the property. Here’s how land trusts work as well as the pros and cons of placing real property into a trust.

How Does a Land Trust Work?

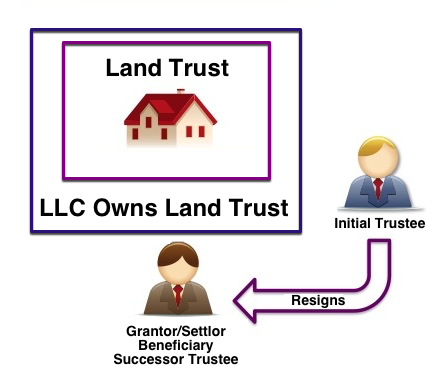

To understand how a real estate trust works, first it is important to understand who each involved party is and what they do. As mentioned above, a land trust is a contractual agreement to which a property holder (settlor or grantor) initiates and transfers the title to said property to another party, known as a trustee. The trustee is presented with terms of the trust and must act in the best interest of the beneficiary (the individual or group of individuals for whom the trust is created). It is not uncommon for the settlor and the beneficiary to be the same person.

In most circumstances, the trustee reports to the beneficiary for management decisions. Essentially, the land trust contract itself is between the trustee and the beneficiary/settlor. In terms of real estate trusts, these management decisions are in regard to things like rent, improvements/developments, occupation and sale of the property.

Pros and Cons of Real Property Trusts

Red Hawk Realty brokerage owners Donn Bree and Meriah Druliner discuss the benefits (pros) of putting a property in a trust.

Pros:

1. Reduces Your Tax Burden

Despite what you may have heard, a real estate trust will not help you avoid paying your taxes. There are, however, certain tax benefits for placing your land in a trust. Depending on local laws, your property may be in an area where business income taxes are lower than personal income taxes. In that case, you may want to set up your business as the beneficiary. Additionally, a trust can also reduce the tax burden for your heirs depending on their intended use for the inherited property.

2. Allows You to Remain Anonymous

When transferring ownership of property to a trust, public records associated with that property will be changed to the trustee’s name instead of yours. This helps you keep ownership private and away from solicitors.

3. Protects You from Liability

A trust provides limited additional liability protection. Putting land assets in a trust prevents others from learning your personal net worth. Keep in mind though that a genuine lawsuit will unearth details of your trust as you are the settlor – therefore it does not provide you with a blanket level of trust.

4. Helps Minimize the Difficulty of Probate

A probate is an official proving of a will where the assets of the deceased are parceled out to heirs. A land trust eliminates probate because it puts the assets protected into a vehicle where the land is transferred to the beneficiary smoothly should the settlor’s death occur.

5, Makes It Easy to Transfer Property

If the grantor and the beneficiary are both alive, a trust can avoid the taxes associated with the exchange depending on the state that the property is located.

Cons:

1. Loss of secondary market loans

It may be difficult to refinance or borrow against the property if the ownership is vested in a trust. In this case, you may need private lenders to assist with refinancing. Contact us if you need help finding private real estate lending.

2. Misconceptions about taxes, protections and privacy

There are many false beliefs about land trusts and the protections, benefits and privacy that they offer. One is that land trusts protect beneficiaries from all liability. This is not the case and in many states, courts have precedent against this stance. Courts can also order full disclosure of property ownership in civil and criminal complaints. Lastly, the IRS requires all trusts, including land trusts to pay taxes with Form 1041.

3. Cost of setting up a trust

Setting up a land trust requires legal guidance and upfront fees all of which vary depending on the type of property, location and number of properties in the trust.

4. Inconvenience of transferring real property into and out of a trust

Transferring property into and out of a trust takes time, particularly in the form of billable attorney hours and processing times. It’s important to set timeline expectations when it comes to trust activities.

How to Set up a Land Trust

If you are interested in setting up a trust for your next real estate purchase, contact us. We work with experienced consultants who can help you set up a trust for any real property. It is important to find professional help so that you can get all of the benefits of setting up a land trust without leaving yourself exposed to litigation. Contact us today: (800) 371-6669